Tax System

Seychelles Tax System

The Seychelles has historically operated a territorial tax regime, meaning that only income sourced in Seychelles was liable to tax in Seychelles. Income was considered Seychelles’ sourced income exclusively where it arose from business “activities conducted, goods situated or rights used” within the physical territory of Seychelles. This meant that income was considered non-Seychelles sourced income (i.e. “non-taxable business income”) where the income was:

- From activities conducted by a Seychelles business in an overseas jurisdiction (through a branch, office, shop or otherwise); and

- In the form or dividends, interest, royalties, rents and other “passive income” received by a Seychelles resident from a non-resident.

The changes of law applying from 16 September 2021, adopts a revised approach for covered companies, including the adoption of an economic substance test for passive income received from a non-resident.

Self-Assessment

The self-assessment regime was introduced in 2010 to encourage voluntary compliance. The regime places the responsibility of tax on the taxpayer operating in Seychelles to determine if it has Seychelles sourced income in a tax year, to declare and report on their taxable income, for the relevant tax period with permitted deductions and exemptions, in line with applicable laws.

Business Registration

All new businesses must register with the Seychelles Revenue Commission (SRC) within 28 days of trading. For new businesses with employees, the business must register all of its employees within 7 days of employment. For more information on how to register your business click here TMS

Record Keeping

Businesses must keep any records such as books, sales ledger, expenses, assets, receipts of cash, purchases, banking records and relevant data for a period of 7 years as may be prescribed in English, French or Creole.

Submission of Business Tax Return

All business tax return must be submitted to SRC no later than 31 March of every tax year, unless approved by the Commissioner General, as stated in the Business Tax Act 2009, Section 26, thus granting a taxpayer a period of three months after the end of each tax year to submit their business tax return. For the avoidance of doubt, a business tax return is required irrespective of any tax liability or loss.

Updating Tax Records

Taxpayers have 28 days to notify the Commissioner General in writing about any changes related to information within their business provided to SRC which has occurred. Taxpayers must advice on these changes within 28 days of which the change in information has taken place at the time of submitting their application or upon registration. Additionally, taxpayers must also submit to SRC within 28 days any information upon request from the Commissioner General. Where an executor is appointed for administration of a business, the executor has 90 days to notify SRC about the appointment.

Suspension of Tax Obligations

Taxpayers who have the intention to suspend their business operations and tax obligations, must to notify the Commissioner General within 14 days about their intention and the reason therefore with any supporting documents. Taxpayers who had suspended their business, intending to resume and re-activate their tax obligations, must within 14 days notify the Commissioner General of their intention prior to resuming operations.

Suspension of Tax Status

The Commissioner General has the power to suspend a taxpayer’s status without prior application if it has been satisfied that the operator of the business:

- is unable to continue the business operation due to serious illness, serious physical or mental disability

- has died

- is declared bankrupt

- is missing

- is in jail consequent of punishment for imprisonment for an offence

Business De-Registration

Taxpayers who intend to permanently de-register their business, should notify the Commissioner General in writing about their intention to de-register their business with SRC within 28 days from the date of cessation of their business.

Dormant Taxpayers

Based on conclusive evidence that a business is dormant, the Commissioner General has the power to change the business status from active to dormant. A dormant taxpayer is a taxpayer issued with a tax identification who was previously conducting activities within its business, but has not been active or engaged in any transaction with SRC, nor have any active audit and cannot be located for the last 3 years or more. The taxpayer has not applied for suspension or cessation of their business operations.

Offences and Penalties

A person who fails to:

- register his or her business under regulation 3(1) or (2);

- register his or her business under regulation 3(1) or (2), but is subsequently registered in pursuance of regulation 3(3);

- notify the Commissioner General under regulation 4(1)(a);

- provide information requested for within 28 days under regulation 4(1)(b);

- notify the Commissioner General under regulation (4)(2);

- notify the Commissioner General under regulation 5 or 7, commits an offence and is liable on conviction to imprisonment for a term of one year or to a fine of SCR 50,000 or to both such fine and imprisonment.

Tax Payment via Bank Transfer

As from 1 April 2023, the following bank account details must be used for all tax payments as follows:

- Account Name: Seychelles Revenue Commission – Collection Account

- Bank Name: Central Bank of Seychelles

- Account Number: 14192

- Account Currency: SCR (Seychelles Rupees)

- IBAN: SC82SSCB11010000000000014192SCR

Taxpayers must use the correct bank account details as shared above for all bank transfers and email receipt or proof of payment to banktransfer@src.gov.sc

Payment by Instalments (Appendix 22&23)

The Seychelles Revenue Commission (SRC) may at any time during the recovery process, request a taxpayer to pay an outstanding debt by instalment.Or the taxpayer may make such a request. Payment by instalment is in accordance with the Revenue Administration Act 2009, Part 5 section 22 (1-4). However, taxpayers should understand that SRC will not suggest taxpayers to pay a debt by instalment, unless it is seen as a negotiable outcome as immediate payment is preferable.

Payment by instalment is subject to the following terms and conditions:

- The age of the debt.

- Whereby new debts are concerned the payment should be settled within 1 to 3 months

- Payments by instalments should be completed within 6 months, for example if the debt has moved from Debt Pursuit to Enforcement stage.

- For companies with debt above SCR 1 million, the debt should be settled by instalment upon approval over a period of 1 year (12 months).

- All debts agreed to be settled by instalment should be paid to SRC by the taxpayer within the agreed period.

- In complex situation beyond SRC’s control, an extended period of six months can be provided for payment of the debt by instalment, following a thorough review of the case and approval of the Enforcement Unit.

To request for payment of debt by instalment, the taxpayer must complete the below application forms:

The form will be reviewed by the Enforcement Manager/ Director for approval. Taxpayers are requested to provide as much information when completing the form including full contact details. The taxpayer will be informed in writing on the status of the application submitted. If approval is granted, the taxpayer will be advised on the final terms and conditions of the debt recovery and payments.

Important Notice

- Taxpayers failing to meet the terms and conditions of payments of debt by instalments will be contacted by SRC to re-negotiate the payment plan.

- If taxpayer still fails to pay the debt by instalment after completion of (i); the debt owned to SRC will become payable immediately as per Section 22 (3) of the Revenue Administration Act 2009.

- SRC will contact the taxpayers to inform about the default in payment by instalment and the process to follow. (Appendix 18).

- For those compliant to the terms and conditions of the payment by instalment, SRC will on a monthly basis advise the taxpayer about the payments made including the remaining outstanding balance. (Appendix 25)

- Upon completion of the full payment of the debt, the taxpayer will also be contacted by SRC to confirm nil balance outstanding.(Appendix 27)

“If a taxpayer permitted to pay revenue by installments defaults in the payment of an installment, the whole balance of the revenue outstanding, at the time of the default, is immediately payable.”

Domestic Tax

Business Tax

Business tax is applicable on the taxable income of a business activity. Taxable income in simplified term is assessable income less any allowable deductions (except for those exempted as per the Second Schedule of the Business Tax Act as amended in 2021).

Business Tax is levied at different rates depending on the business structure (e.g. sole trader, company or partnership), or the economic sector under which the entity or person operates (as per SI 108 2021 of the Business Tax Act) (Amendment of Schedules) (Regulations 2021).

The Business Tax Act covers three main regimes:

Applicability

Introduced in January 2013 under the Tenth Schedule of the Business Tax Act, 2009 as amended, for small businesses with an annual turnover below SCR 1 million.

Tax Rate

Applicable at a flat rate of 1.5% on the annual business turnover of the current year (that is the year in which the revenue is earned). For example, the Presumptive Tax due (payable) in 2022 depends on the 2021 annual turnover of a business.

Filing and Lodgment of Return

Under the presumptive tax regime, taxpayers must file and lodge a simplified one-page return to SRC, by the 31 March of every year inclusive of the tax liability due.

Under this regime, taxpayers can only declare their turnover (income received) and no expenses are allowed. However, taxpayers are encouraged to keep records of both income and expenses for a minimum of 7 years in case in the latter years, the threshold is exceeded and the business activity falls under the business tax regime.

- Pre-Payment Option for Presumptive Tax

‘Pay As Your Earn’ (PAYE) Scheme – In 2022 the Seychelles Revenue Commission (SRC) introduced the ‘Pay As You Earn’(PAYE) scheme to allow businesses under the Presumptive Tax Regime to pay their taxes as and when they receive an income, to relieve the potential financial burden at the end of the tax year. - How it Works

Businesses with a turnover of less than SCR 1 million voluntarily pay their tax, that is 1.5% of their income received in any particular month to SRC. The amount of tax paid will be credited to the taxpayers’ business account with SRC and will be offset when the taxpayer lodges the presumptive tax return at the end of the year by paying the difference in the lodgment (if any). Any surplus recorded in the tax payment will be carried forward as credit onto the taxpayers’ business account with SRC or refunded upon request. - How to Pay

Under the PAYE scheme, taxpayers can remit their tax payment to SRC at any time by completing the ‘Tax Payment Slip’ for Pay As You Go Installment for Presumptive Tax’ when effecting payment. To download the form, click : Tax Payment Slip - Penalties

No penalties will apply if payment is not made in a particular month, but taxpayers must ensure to lodge their return on time. - Exemption

Businesses categorized as ‘Specified Businesses’, using the Deduction At Source (DAS) booklet and businesses currently under the ‘Pay As You Go’ scheme are exempted from PAYE.

- Applicability

- Applicable to businesses with an annual turnover exceeding SCR 1 million

- Tax Rate

- Varies for sole traders, partnerships and companies as follows:

| Category | Tax Rate |

|---|---|

| Sole Trader and Partnership |

|

| Company |

|

- Filing and Lodgment of Return

- Under the business tax regime, taxpayers must file and lodge a five-page return to SRC (Hover and download the five-page return), conduct one tax payment by the 31 March of every year, report their income and expenses on cash basis, keep records of income and expenditure for a minimum of 7 years. In regards to a company, the business tax payable to SRC under this regime is on any net profit that the company derives.

- Extension of Lodgment:

- A taxpayer can request for a substituted tax year to the Commissioner General, if the taxpayers’ accounting year end defers from 31 December. In line with Section 57 of the Business Tax Act, the business must furnish a business tax return for each tax year within three months after the end of the substituted tax year in the prescribed form and manner to SRC. The payment of any taxes due should be done at the time of lodging the return within the three months’ period.

- A taxpayer under an approved Tax Agent Lodgment Program for business tax return may have a different lodgment date as follows:

| Activity | Lodgment Date |

|---|---|

| Sole traders, partnerships engaged in taxable supplies. | 30 June |

| Companies engaged in taxable supplies. | 31 July |

| All sole traders, partnerships and companies engaged in non-taxable supplies. | 31 October |

| Taxpayer with an approved substituted tax year by the Commissioner General. | Three months after the accounting period ends or by 30 September the earliest. |

- Pre-Payment Option

- ‘Pay As You Go’(PAYG) – A scheme under the Business Tax Act for businesses to pay their taxes as they go (PAYG) on a monthly basis.

- How it Works

- Taxpayers must submit the dedicated Return Form and the Tax Payment Slip when effecting payment on the 21st day of the following applicable month along with the tax payment to the Seychelles Revenue Commission (SRC)

- How to Pay

- Taxpayers must submit the completed ‘Business Activity Statement’ (BAS) when effecting payment to SRC. The BAS must be submitted on the 21st day of the following applicable month along with the tax payment to the Seychelles Revenue Commission (SRC). (Hover and click on the ‘Business Activity Statement’ to view and download the form.)

- Penalties

- Failure to submit the dedicated Return Form and Tax Payment Slip within the aforementioned timeframe will result in additional penalties, interest and charges.

-

There are two types of withholding tax under the Business Tax Act as follows:

- Withholding Tax

- Withholding of Tax from Payments to a Specified Business (Deduction at Source)

Withholding Tax

- Applied on the gross amount of interest, dividends, royalties, technical and managerial service fees as well as natural resources, derived by a non-resident person from sources in Seychelles.

- Applicability

- To collect such tax, the payer, that is the person responsible for paying the fees to the non-resident, must withhold the tax from the gross payments made to the non-resident and remit same using the ‘Business Activity Statement’ (BAS) to the Seychelles Revenue Commission (SRC). The payer must bear in mind the provision for permanent establishment under the act and the double taxation avoidance agreements DTAA signed by Seychelles, to determine the liability for withholding tax. If in doubt, contact SRC via email at advisory.center@src.gov.sc

- Tax Rate

- Withholding tax is due and payable to the Seychelles Revenue Commission (SRC) on or before the 21st day of the following applicable month. As withholding tax is a final tax, income that is subject to withholding tax is not liable to business tax.

| Categories of Income Liable to Withholding Tax | Tax Rate |

|---|---|

| Dividend, interest, royalty, natural resource amount, or technical services fee paid to a non-resident. | 15% |

Dividends paid under Section 62 by:

| 0% |

| In respect of a promoter, agent, or similar person paying remuneration to a non-resident entertainer or sports person in respect of a performance or sporting event in Seychelles. | 5% |

| Managerial fees paid to a non-resident by a financial institution operating in Seychelles. | 33% |

| Insurance premium paid to a non-resident. | 5% |

| Interest on current account, fixed deposit and call deposit of residents and non-residents (in Seychelles Rupees or foreign currency). | 5% |

| Interest on savings account, bank to bank transfers and non-residents bank interest. | 0% |

| Managerial fees paid to a non-resident by a financial institution operating in Seychelles. | 33% |

| Interest on Bearer Bonds. | T5% |

| Interest paid by a person being a non-financial institution to a person not being a financial institution. | 15% |

| Treasury Bills (where the recipient is not a resident or a non-resident financial institution as defined in the Financial Institutions Act 2004 or carrying on the business as an insurer as regulated under Insurances Act, 2008). | 15% |

| The rate of withholding from the gross payment made to a specified business listed in the Fourth Schedule of the Business Tax Act. | 15% |

Withholding of Tax from Payments to a Specified Business (Deduction at Source)

- Deduction At Source (DAS)

- Is the collection of tax directly from the very source of payment for services rendered by specified businesses.

- Applicability

- To collect such tax, the payer, that is the person responsible for paying the fees to the non-resident, must withhold the tax from the gross payments made to the non-resident and remit same using the ” Withholding Tax Remittance Form and the Tax Payment Slip” to the Seychelles Revenue Commission (SRC). The payer must bear in mind the provision for permanent establishment under the act and the double taxation avoidance agreements DTAA signed by Seychelles, to determine the liability for withholding tax. If in doubt, contact SRC via email at advisory.center@src.gov.sc

- There are five categories of specified businesses under the fourth Schedule of the Business Tax Act 2009 as follows:

- Maintenance Contractor (e.g. landscaping, cleaning).

- Building Contractor.

- Mechanic (motor vehicle, marine or refrigeration).

- Hirer of Omnibus.

- Hirer or operator of plant, equipment including sea vessels, motor vehicles used for transportation of goods and for towing.

- Tax Rate

- Effective 2020, the payer must withhold 1.5% of the total amount paid to the specified business.

- Payment Method

- Tax deducted at source should be remitted on or before the 21st day of the following applicable month. Upon submission of the withholding tax payment to SRC, the payer must enclose the blue page of the Deduction At Source (DAS) book with the completed ‘Business Activity Statement’ (BAS).

- Credit for Tax Withheld

- Deduction at source payments are accumulated as a credit and held by SRC on behalf of the taxpayer. The credit is used to offset any business tax assessed following lodgment of the return in respect of that particular year, whilst any excess will be refunded to the taxpayer.

- If the tax has been withheld from income derived by a person, the amount of income included in the assessable income of that person is the amount derived before the withholding of tax (gross amount).

Value Added Tax

Value Added Tax (VAT) introduced in 2010, is the tax imposed on goods and services supplied in the Seychelles (taxable supplies) or imported into the Seychelles (taxable imports). Generally, VAT is considered as follows:

- Consumption tax- Charged on the sale of goods and services to consumers.

- Broad based tax Applied- on all purchases of goods and services unless exempted. VAT is paid at the point of entry and / or at each stage of production and distribution in a value chain.

- Destination based tax- Levied where the goods is consumed.

VAT is ultimately borne by the final consumer.

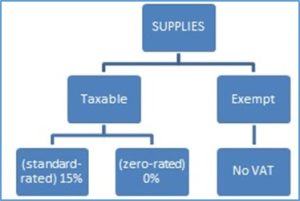

The VAT system comprises of the taxable and exempt supplies.

- Taxable supply is a term used for the sales of goods and delivery of services on which VAT can be charged, even if the tax rate is 0%.

VAT Rates on Taxable Supplies

The two types of VAT rates applicable on taxable supplies are as follows:

- The 15% standard rate applied on most imported goods or services sold in Seychelles.

- The zero rated (0%) applied on exports of goods and on specific items as specified in Schedule 2 of the Value Added Tax Act, 2010.

Collection of VAT on Taxable Supplies

VAT on Taxable Supplies

VAT registered businesses making taxable supplies (goods and services) collect VAT from their customers at the point of sale. The VAT charged should be shown separately from the sales price on the invoice and receipt issued by the VAT registered business.

VAT on Zero-rated Supplies

VAT registered businesses making zero-rated supplies will charge VAT at 0% on the selling price, meaning VAT will not be shown on the invoice nor will it be charged and paid by the customer.

A VAT registered businesses will only remit to the Seychelles Revenue Commission (SRC) the difference between the output tax (VAT charged on sales) and the input tax (VAT paid on purchases).

A VAT refund is possible if the input tax exceeds the output tax (in other words a VAT credit).

Exempt Supplies

Are goods or delivery of services sold which are not liable for payment of VAT. Exempt supplies are enumerated under Schedule 1 of the VAT Act 2010 and they include goods such as pharmaceutical products, infant formulae, pampers and certain basic necessities (e.g. rice, lentils …etc) and services such as education, health and financial services.

VAT Rates on Exempt Supplies

Compared to taxable supplies where an invoice showcasing the VAT payable by the customer is clearly visible and businesses engaged in taxable supplies can claim credit or refund with the Seychelles Revenue Commission (SRC), businesses providing exempt supplies are excluded from payment of VAT and cannot claim a credit or refund on the exempt goods sold or services rendered.

Businesses that exclusively make exempt supplies should not be registered for VAT.

Under the VAT system, only taxable registered businesses can recover the VAT paid on purchases and imports, by claiming the VAT as an input tax credit, provided that the expenses incurred are for the purpose of the business. A taxable business can recover the VAT incurred on purchases if the expenses made are deductible (that is the VAT on these purchases can be claimed back), or if the expense has been used in the process of making taxable supplies. However, an input tax credit cannot be given if the taxable purchase is used to make an exempt supply. Unless used for the making of taxable supplies specific to the activity of the business, input tax credit is not allowed on the following taxable supplies:

- Passenger vehicle, spare parts or repair and maintenance services.

- Petroleum products.

- Entertainment.

- Accommodation.

- Any supplies used to provide membership or entrance for any person in a sporting, social or recreational club, association, or society.

For more details, view Section 25 of the Value Added Tax Act 2010 or email advisory.center@src.gov.sc

All goods imported into the Seychelles are treated as a taxable transaction under the VAT Act 2010 regardless of the status of the importer, (if the importer is VAT registered or not) or the nature of the transaction (commercial or personal importation).

VAT on importation is assessed by the Customs Division of the Seychelles Revenue Commission (SRC) and is paid at the point of entry together with Customs duties either at Seaport, Airport and the Post Office. VAT registered businesses can claim input tax credit on importation of taxable supplies.

However, there are certain goods, class and categories of persons exempted from paying VAT at the point of entry.

For more details on the exempted list, view the First Schedule of the Value Added Tax Act 2010 or email advisory.center@src.gov.sc.

VAT Calculation on Importation

VAT on imported goods is applied on the value of the import (Customs value) which is the CIF (Cost, Insurance, and Freight) + customs duties (excise tax where applicable).

The threshold for mandatory VAT registration is SCR 2 million.

- Compulsory Registration

Applies to businesses with a total value of taxable supplies made or reasonably expected to be made during a certain period equal to or greater than the threshold of SCR 2 million.

If the business is already registered with SRC, a VAT registration form will be sent to the business to complete the registration process. This will be followed by a letter confirming the status of registration, issuance of the VAT registration certificate and sticker to display at the principal place of business. For new businesses registering for VAT, click here. (Add link with TMS for new business registration).

- Voluntary Registration

Voluntary registration currently applies to businesses making taxable supplies below SCR2,000,000. Effective 1 January 2025, voluntarily registration for VAT will apply to business making taxable supplies at the minimum threshold of SCR 100,000 to SCR 2,000,000. To determine the eligibility of the application prior to granting approval, the Seychelles Revenue Commission (SRC) will conduct a field visit at the premises of the business to: - Determine if the business is actually making or will make taxable supplies.

- The business has a fixed place of operation.

- The business has commenced trading and is keeping proper records of all transactions.

- The business is complying to all obligations under the revenue laws including licensing for cash register.

- There are enough reasonable grounds to believe that the business will keep proper records and furnish regular and reliable VAT returns to SRC.

Having met all these requirements, the Commissioner General will issue the business with a letter confirming the status of registration, a VAT registration certificate and a VAT sticker to display the principal place of business.

A business must apply to the Commissioner General for VAT registration at the beginning of any 12-month period if there are reasonable grounds to expect that the business will exceed the registration threshold within that period or at the end of any 12 month or lesser period, if in that period the person exceeds the registration threshold by completing the VAT registration form.

Corporate Social Responsibility Tax

The Corporate Social Responsibility Tax (CSR) Act 2013 which came into effect on 1 January, 2014 was repealed on 20 April, 2021. However, any CSR tax payment falling due prior to 20 April, 2021 can still be collected or paid.

As such with effect from 21 April 2021, businesses wishing to make any donations or sponsorships must follow Section 23 and the Fifth Schedule of the Business Tax Act, 2009 relating to ‘Approved Gifts’ as follows:

Approved Gifts’

Gifts (other than the gifts referred to in paragraph 1A) made to public fund, body, institutions, charities or non-governmental organizations shall be 150% deductible from the business assessable income.

For the purpose of this schedule:

- a) Gifts shall also include donations.

- b) Charities and non-governmental organizations shall be registered with the Ministry of Finance, National Planning and Trade as a charity or non-governmental organization and issued with a certificate confirming its status.

Immovable Property Tax

The Immovable Property Tax Act 2019, applicable to all non-Seychellois owning an immovable property in the Seychelles, came into effect in January 2020. Immovable properties comprise of condominium units, commercial and industrial properties, buildings used for residential purposes, freehold or leasehold land, multi-purpose buildings as well as villas.

All non-Seychellois property owners must register the ownership of their immovable property at the office of the Registrar General located at the Independence House in Victoria or submit the completed registration form via email to propertytax@registry.gov.sc. A period of four months will be gazetted each year for registration.

Following registration, the immovable property will be valuated by the Ministry of Land Use and Housing. In accordance with the Immovable Property Tax Act, failure to submit an application to the Registrar General will result in fines payable to the office of the Registrar General as follows:

- SCR 50,000 in the case of a commercial, industrial and multi-purpose properties including villas.

- SCR 10, 000 in the case of any immovable property not specified above.

Following amendments to the Immovable Property Tax Act, 2022 (Act 14), the Registrar General can automatically register a non-Seychellois on the immovable property owners register, based on the following circumstances:

- The immovable property is transferred to the non-Seychellois through death, bankruptcy, insolvency or liquidation under the Land Registration Act.

- Proof of possession and judgement or order of the court showing that the property should be transferred to a non-Seychellois.

- Where the Registrar General registers an instrument of transfer after being satisfied that the non-Seychellois is granted a sanction under the Immovable Property (transfer restriction) Act.

The person owning an Immovable property used for residential purposes including part of any multi-purpose building used for residential purposes

The tax payable in a financial year is imposed on 1st January of every year.

The immovable property tax rate is 0.50% of the of the property’s market value, payable to the Seychelles Revenue commission (SRC) on or before 31 December of every financial year. All payments should be accompanied by the notice of valuation provided by the Chief Valuation Officer and the Business Activity Statement (BAS).

Immovable Property Exempted from Tax PaymentTax shall not be paid on immovable property:

- Considered to be a commercial or an industrial property.

- Property used for residential purposes that is owned by a taxpayer who is married to a Seychellois

A non-Seychellois who after coming into operation of this Act meaning after 1st January 2020, becomes a first time owner of an immovable property used for residential purposes is exempted from payment of immovable property tax for a period of one year from the date of owning the property. This process is based upon application in writing to the Commissioner General.

Effective August 2022, all immovable property owners submitting their valuation in foreign currency, are advised that every year the approved valuation amount will be converted into Seychelles rupees (SCR) using the mid-rate of exchange for drafts issued by the Central Bank of Seychelles for each respective currency that is in Dollars ($), Euros (€) or Pound Sterling (£).

An approved valuation amount is valid for five years and every year after the first year of the valuation, the Seychelles Revenue Commissions (SRC) will issue a statement of the tax payable for the particular year based on the new conversion of the approved valuation amount, using the rate of exchange on the 1 January of the applicable year. The tax payable will then be based on the converted valuation amount for the applicable year.

All taxpayers will need to submit a new valuation form to the Chief Valuation Officer whereby a new notice of acceptance or validation as applicable will be issued.

Taxpayer who submitted their valuation in Seychelles Rupees shall make payment based on the tax payable amount stated on the Notice Acceptance/ Valuation Submitted by the Chief Valuation Officer every year until the end of the five-year validation period. No statement of tax payable for this category of taxpayers will be issued by SRC.

Non-Seychellois can pay immovable property tax in Dollars ($), Euros (€) or Pound Sterling (£) only through bank transfer. The amount paid will then be converted by the Seychelles Revenue Commission (SRC) using the Central Bank of Seychelles mid-exchange rate of the day, on the date that the payment is received.

Taxpayers must hold sufficient amount of funds when conducting payments through bank transfers to cater for possible fluctuations in the rate of foreign exchange. Any surplus in the payment received to SRC will be carried forward as a credit onto the taxpayers account with SRC into the following year.

Payment of Immovable Property Tax in Seychelles rupees is only accepted in person directly at any SRC offices based on Mahe, Praslin or La Digue.

Tourism Marketing Tax

The Tourism Marketing Tax (TMT) was introduced in January 2013 to fund marketing activities and promote Seychelles as the number one tourist destination in the world, in addition to ensuring continuity in tourism-related investments.

Applicability

Applicable for the following business activities:

- Hotels, guest houses, self-catering establishments;

- Cafés or restaurants;

- Fixed or rotary wing passenger air transport services;

- Domestic ferry services for the transport of freight or passengers;

- Boat or yacht charterers (including live-aboard);

- Car hire operators;

- Underwater diver operators or dive centers;

- Water sports operators;

- Travel agents;

- Tour operators;

- Tour and or tourist guides;

- Equestrian operators;

- Banks;

- Insurance companies (excluding brokers); and

- Telecommunication service providers.

- Building contractor (class 1)

- Casino operators

Tax Rate

The rate of Tourism Marketing Tax payable by a business with an annual turnover of SCR 1 million and above is 0.5%.

Filing and Lodgment of Return

Filing and lodgment of return for Tourism Marketing Tax is made on the 21st of the following applicable month on the Business Activity Statement (BAS).

Accommodation Turnover Tax

The Accommodation Turnover Tax recently came into operation on 1 January, 2023.

Applicability

All tourism accommodation operators, namely hotels, guesthouses, self-catering establishments, yachts, cruise and ships. For more information, refer to the Accommodation Turnover Tax Act, 2022 available here.

Threshold for Liability

- Tourism accommodation operators with an annual turnover of SCR 100,000,000 and above and above.

- The liability will depend on the annual turnover of the previous business year, under the above category with a turnover of SCR100,000,000 and above for the tax year 2022.

- Businesses must monitor their income during the year 2023 and remit the Accommodation Tax Turnover to the Seychelles Revenue Commission (SRC) as soon as the business reaches the threshold of SCR 100,000,000.

Tax Rate

The rate of Accommodation Turnover Tax payable by a business as soon as the business reaches the SCR 100,000,000 threshold and above is 2%.

How to Pay

Payment for the Accommodation Turnover Tax is made on the 21st of the following applicable month on the Accommodation Turnover Tax Returns Form to SRC.

Note payment for the Accommodation Turnover Tax cannot be claimed as an expense in the yearly Business TAX Return.

Penalties

Failure to submit payments within the aforementioned timeframe will result in additional penalties, interest and charges.

Refund Process

As the amendment to the Accommodation Turnover Tax law took effect on 1 January 2023, tourism accommodation operators with an annual turnover lower than SCR 100,000,000 who had already as from 1 January, 2023 remitted their Accommodation Turnover Tax payment to the Seychelles Revenue Commission (SRC) will be legible for a refund.

To request for a refund, tourism accommodation operators must email SRC on refund@src.gov.sc providing the following information:

- Taxpayer Identification Number (TIN).

- Business Trading Name.

- Date of Accommodation Turnover Tax Payments remitted to SRC.

- Any other relevant supporting documents.

Refunds will be processed on a first come first serve basis.

Tourism Environmental Levy

The Tourism Environmental Sustainability Levy recently came into operation on 1 August, 2023.

Applicability

All tourism providers such as hotels, guest house, self-catering establishments, yachts and island resorts, offering accommodation to visitors. For more information, refer to the Environment Protection (Tourism Environmental Sustainability Levy) Regulations, 2023 available here.

The levy shall be collected by the accommodation establishments from the guest who occupies an accommodation establishment regardless of who makes the reservation or is responsible for the payment of stay.

Notification of Levy

The accommodation establishment shall notify the guests of the requirement for the payment of the levy and shall list the levy on the invoice for the guests to pay.

Threshold for Liability

Imposed on every guest in an accommodation establishment at the rates and classification as per the classification of the tourism establishment:

• Small tourism accommodation (1-24 rooms).

• Medium tourism accommodation (24- 50rooms).

• Large tourism accommodation (51 rooms onwards).

• Yachts and Island resorts.

Tax Rate

The imposition of the tax is applicable per visitor per night. The levy rate is as follows:

• Small tourism accommodation (1-24 rooms) – SCR 25 per person per night.

• Medium tourism accommodation (24- 50rooms) – SCR 75 per person per night.

• Large tourism accommodation (51 rooms onwards) – SCR 100 per person per night.

• Yachts and Island resorts – SCR 100 per person per night.

How to Pay

Payment for the Tourism Environmental Sustainability Levy is made on the 21st of the following applicable month using the Tourism Environmental Sustainability Levy Returns Form to SRC.

Exemptions

Citizens of Seychelles, resident person, airline cabin crew, yacht crew and child of 12 years and below is exempted from payment of the levy.

Penalties

Failure to submit payments within the aforementioned timeframe will result in additional penalties, interest and charges.

Keeping of accounts and records

Every accommodation establishment shall keep a register maintained either in

English, French or Creole for collecting the levy containing the following details:

(a) Name and age of the guest;

(b) Check-in and check-out dates;

(c) Documents as proof of exempted guests;

(d) Amount collected from each guest; and

(e) Any other documents for determining the levy payable for

any payment period.

The accounts, documents or other records must be retained for a period of seven years.

Transfer Pricing

Transfer Pricing – Related Party Dealings (RPD) Schedule

A person that enters into a controlled arrangement under Section 54 (1) of the Business Tax Act (Cap 20) is required to complete and furnish a Related Party Dealings Schedule (RPD) to the Seychelles Revenue Commission (SRC).

The first year of lodgment is for the period 1 January 2024 to 31 December 2024 – the 2024 tax year, (due by 31 March 2025), unless a business has a substituted tax year or a transitional tax year, in which case Section 26 of the Business Tax Act (Cap 20) applies.

A decision has been made to apply the RPD Schedule to this period rather than the 2023 tax year, which will provide taxpayers and their advisors additional time to complete this new obligation accurately.

The SRC is encouraging taxpayers and advisors that have already prepared the RPD schedule, or are intending to do so, to furnish it to the SRC. This will provide certainty and transparency around the related party dealings and potential level of risk involved. To obtain the RPD Schedule please click here

The Related Party Dealings Schedule includes disclosures per Regulation 3(1) of the Business Tax (Related Party Dealings) Regulations, 2023.

For more information, please view the Simplified Related Party Dealings Schedule Guidance here.

Transfer Pricing Documentation

A person that enters into a controlled arrangement under Section 54 (1) of the Business Tax Act (Cap 20) and has an annual turnover that exceeds SR1,000,000 shall prepare documentation that would verify that the conditions in its controlled arrangements for the relevant tax year are consistent with the arm’s length principle, for the purpose of computing the measure of taxable profit for that tax year.

A person shall prepare additional transfer pricing documentation for all controlled arrangements between associates, if :

(a) the total value of all controlled arrangements is more than 10% of the person’s turnover for a tax year; or

(b) the total value of all controlled arrangements for a tax year exceeds an amount equivalent to SR50,000,000.

A person who is a member of a multinational enterprise group and whose consolidated turnover is greater than EUR 100 million shall, in addition to the transfer pricing documentation, prepare a Masterfile in accordance with the OECD Transfer Pricing Guidelines for Multinational Enterprises and Tax Administrations.

The transfer pricing documentation required to be prepared is specific in the Business Tax Transfer Pricing Documentation) Regulations, 2023.

A person shall, upon request of the Commissioner General, furnish to the Commissioner General the relevant transfer pricing documentation, within 21 days from the date of the request. Unlike the RPD Schedule, transfer pricing documentation is not required to be furnished to the SRC unless requested by the Commissioner General