About us

Who We are

The Seychelles Revenue Commission (SRC), 2009 was established on 1 January 2010, following the enactment of the Seychelles Revenue Commission Act 2009 (SRC Act). SRC is responsible for the administration of revenue laws in the Seychelles, under the Act, and is mandated to operate as an independent authority with the responsibility of conducting its affairs in a transparent and efficient manner, under the purview of the Ministry of Finance, National Planning and Trade, the body overseeing major fiscal policy issues affecting revenue collection. SRC is also functioning under the aegis of a Governing Board as per the SRC Act.

Our Mission

Building trust through well governed, customer oriented and transparent processes to facilitate trade and optimize revenue collection for the sustainable well-being of Seychelles.

Our Vision

To be a modern, robust and innovative revenue administration for ease of doing business whilst meeting the highest international standards.

Our Values

Professionalism, Resilience, Ownership, Fairness, Integrity, Transparency and Trust.

Our Motto

Contributing to transform Seychelles.

Governing Board

The first Governing Board of the Seychelles Revenue Commission (SRC) was appointed in March 2018, following amendments to the SRC Act in the same year, making provision for the Commission to be administered by a Board, in accordance with the new governance policies that was being applied across the public sector at the time. The Governing Board of SRC comprises of eight members including the Commissioner General as an ex-officio member.

The Board’s term in office is three years of which upon completion, a member may be eligible for re-appointment. The members of the SRC Governing Board currently are:

- Chrystold Chetty – Chairperson

- Cillia Mangroo – Board Member

- Charles Morin – Board Member

- Astrid Tamatave – Board Member

- Ginny Elizabeth – Board Member

- Serge Durup – Board Member

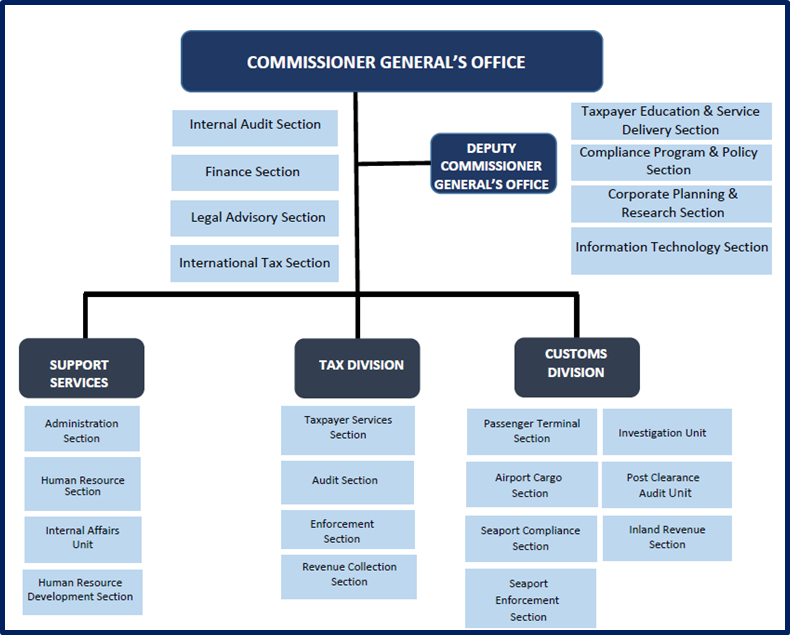

Organizational Structure

The organizational structure of the Seychelles Revenue Commission (SRC) comprises of three main divisions namely Domestic Tax, Customs and Support Services. SRC has at its helm a Commissioner General and a Deputy Commissioner General as provided for under the Seychelles Revenue Commission Act (SRC Act). The Customs and Tax Division respectively are headed by a Commissioner and Support Services by a Director General. Each Section under the respective Division is headed by a Director and the Units have Managers with their second in command (Supervisors) assisting the Directors.

Division and Units

Commissioner General’s Office

The office of the Commissioner General has the overall mandate of administering revenue laws in the Seychelles, in addition to providing advice to the government on revenue policy matters. The office has oversight on the standard and quality of service being provided to taxpayers as well as the general management of the Seychelles Revenue Commission (SRC).

Four units reports directly to the Commissioner General’s Office as follows:

Deputy Commissioner General’s Office

The Deputy Commissioner General holds the second highest rank within the Seychelles Revenue Commission (SRC). Four units reports directly to the Deputy Commissioner General’s Office as follows:

Careers

Join, Stay and Grow with SRC

If you enjoy working in a dynamic and modern environment, then a career at the Seychelles Revenue Commission (SRC) is definitely for you.

Promoting diversity and inclusivity, regardless of background or ethnicity, at SRC we encourage individuality and believe in having the best people in-house to deliver a more professional customer oriented service.

As an employee of SRC, your contribution will be valued for the development of the organization in delivering on its mandate. If you are committed, resilient and looking for a life-long career opportunity, we welcome you to the SRC family!

Vacancies

We are recruiting!

Tuesday 12th November, 2024

CUSTOMS OFFICER LEVEL II – SITZ & EXCISE TAX UNIT – (1 POST)

Job Summary The jobholder will be responsible for attending to duties relating to the control and accountability of raw material and…Tuesday 12th November, 2024

SENIOR CUSTOMS OFFICER – SITZ & EXCISE TAX UNIT – (1 POST)

Job Summary The post holder will be responsible for attending to duties relating to the control and movement of legitimated goods…Tuesday 12th November, 2024

SENIOR CUSTOMS OFFICER – BOARDING, MANIFEST & EXPORT – (1 POST)

Job Summary The post holder will be responsible for supervising the day-to-day activities to facilitate the legitimate movement of vessels, crew,…Application Process

All applicants must include an updated curriculum vitae (CV) with names of referees, copies of educational certificates, copy of national identification card (NIN), passport photo and the completed Employment Application Form available here.

To apply for a vacancy email hr@src.gov.sc or deliver your application at the following address: Director Human ResourcesSeychelles Revenue Commission

3rd Floor, Unity House, Victoria, Mahé

SRC reserves the right to contact the best candidate meeting all requirements and criteria for an interview, once applications have been shortlisted.

Your Pathway to Grow with SRC

The Seychelles Revenue Commission (SRC) encourages professional development and nurturing of talents by providing the chance for one to grow within the organization through knowledge distribution, training and learning opportunities to drive business performance. As part of its capacity building and development programs, SRC maintains a close partnership with international bodies such as the African Tax Administration Forum (ATAF), International Monetary Fund (IMF), Organization for Economic Co-operation and Development (OECD), Common Market for Eastern and Southern Africa (COMESA), World Customs Organization (WCO), United Nations Office on Drugs and Crime (UNODC), and the Southern African Development Community (SADC). The organization also have collaborations with educational institutions nationally such as the University of Seychelles (UNISEY), The Guy Morel Institute (TGMI) and School of Business Studies and Accounting (SBSA).

Our People

Meet some key members of our exceptionally talented team.

Service Delivery Standards

SRC aims to deliver quality and efficient service at all times, to enhance taxpayers’ satisfaction, to maintain a relationship based on responsiveness, reliability and assurance, so as to encourage and strengthen voluntary compliance to its existing laws. In line with its agreed service timeliness, SRC wants to raise it service delivery standards when responding to you, by remaining accountable for all our actions taken. The below service standards highlights what is to be expected from SRC when seeking a service from a respective function of the organization as follows:

Taxation Division

Enforcement Section

- Acknowledgement of request for waiver via: · Email – Within 24 hours. Post mail – Within 3 working days.

- Issuance of tax clearance certificate: · Within 5 to 10 working days.

- Requesting an appointment with one of our staff members from the Enforcement Section: · Appointment to be provided within 5 working days upon receipt of the request.

Audit Section

- Notification of audit to a taxpayer: · 5 working days prior to conducting the audit.

- Audit timeframe based on issue type and business category:

Comprehensive Audit

- Large businesses – 120 working days (4 months)

- Medium businesses – 90 working days (3 months)

- Small businesses – 60 working days (2 months)

Issue Oriented Audit

- Large businesses – 25 working days (5 weeks)

- Medium businesses – 20 working days (4 weeks)

- Small businesses – 15 working days (3 weeks)

Specialized Audit

- 65 working days (12 months)

Revenue Section

- Processing of refunds: Refunds shall be processed and credited into the taxpayer’s accounts within 10 working days.

Objection and Appeal Section

- Receipt of objection application: Acknowledgment to be provided within 3 working days.

- Objection decision standard for comprehensive issue: When all information is available, objection decision should be provided within 47 working days. When more information is requested, objection decision should be provided within 62 working days.

- Objection decision standard for single issue: When all information is available, objection decision should be provided within 16 working days. When more information is requested, objection decision should be provided within 21 working days.

Legal Section

- If all information is available, requests for private ruling, general guidance or enquiries through e-mail will be acknowledged on the same day that the request/application is received and based on the complexity of the situation issuance of the private ruling or general guidance will be provided within 1 to 2 weeks.

Human Resources Section

- Receipt of job application form: •Acknowledgement to be provided on a weekly basis; every Monday. •Hand delivered job applications, candidates will each be contacted via a phone call or email on a weekly basis; every Monday

- Applicants not short-listed for the role: •Candidates not meeting the criteria will be issued with either a registered letter or a scan letter via email within 72hours after shortlisting of applications.

- Applicants not selected for the role: •Candidates will be issued with either a registered letter or a scan letter via email upon after 72 hours after the selection process has been completed.

- Shortlisted job applications: •All shortlisted candidates will be contacted 3 days prior via phone ahead of the interview.

- Selected candidates: •Will be contacted within maximum 2 weeks after being selected for the role and will be provided with the job offer. •The candidate will be provided 72 hours to consider and approve the job offer. •Will have 3 days to accept or decline the job upon receipt of the offer letter by hand delivery or email.

- Entry to SRC: •Appointment of new recruit upon acceptance of job offer will be within 2 weeks to 1 month.

Registry Section

If all information is available taxpayers can expect to:

- Receive their tax identification number within 24 hours upon completion of business registration.

- Existing taxpayers can receive their VAT registration within 48 hours

- Deregister for VAT within 7 to 14 days.

- Receive a response for application for in-active / de-registration within 48 hours (except for VAT/outstanding payments).

- Actual deregistration of a business will proceed for 1 month.

- Receive a response for application to suspend their account within 24 hours

- Response to update their information within 24 hours.

Enforced registration through third party information:

- Send registration letter to taxpayer within 14 days from the day the initial letter was issued.

- Send final reminder to taxpayer after 14 days of the registration letter to prove 7 days has passed from the day of the final reminder letter sent.

- Enforce registration – within 24 hours if there are no response from the final reminder sent.

Automatic registration for missing information:

- Send letter for missing information and provide 7 days from the day of the request to receive the missing information.

- If no response is received after 7 days enforced registration will be conducted within 24 hours.

Provision of Advice Section

Acknowledgement of advice:

- Via email within 24 hours.

- Respond to complex issues within 3days.

Customs Division

Processing of Customs Import Declarations

Upon registering a declaration Customs has:

- 1 working day to verify the declaration.

- 2 working days to process the declaration once payment has been made.

Processing of Export Declarations

Upon making a declaration for export purposes Customs has:

- Maximum 3 working days to process the export declaration

Appointment for Verification

After processing a client’s Bill of Entry, an appointment for verification should be provided as follows:

- Container – Within 1 hour after the Bill of Entry has been automatically transferred to the Examination Unit.

- Breakbulk cargo in sheds – Within 1 hour after the Bill of Entry has been automatically transferred to the Examination Unit

- Direct delivery release – Within 1 hour after the processing of the Bill of Entry has been automatically transferred to the Examination Unit.

- Bonded entries for motor vehicles/alcohol – Within 1 hour after the of Bill of Entry has been has been automatically transferred to the Examination Unit.

- Goods for Inner islands – Within 1 hour after the Bill of Entry has been automatically transferred to the Examination Unit.

Verification and Clearance Container

The timeframe to verify a container is as follows:

- Standard for 20 feet – Clearance through green and blue lane within 1 hour.

- Clearance through red lane within 6 hours.

- Standard for 40 feet – Clearance through green and blue lane within 2 hours.

- Clearance through red lane within 12 hours.

Breakbulk Cargo Container

The timeframe for clearance of breakbulk cargo is as follows:

- Clearance through green and blue lane within 1 hour

- Clearance through red lane within 2 hours.

Parcels by Post

The timeframe for clearance of parcels by posts is as follows:

- Small packets – Clearance of small packets within the SCR 3000 allowance limit within 10 minutes.

- Parcels – Clearance of parcels within the SCR3000 allowance limit within 15 minutes. Clearance of parcels pending receipt with customs value of less than SCR5000 within 1 hour. Clearance of parcels on a bill of entry with customs value of more than SCR5000 within 1 hour.

Air Freight Consignments

The timeframe for clearance of consignments by freight is as follows:

- Clearance of non-targeted shipments (green/blue lane) within 30 minutes per consignment.

- Inspection of targeted shipments (red lane) within 1 hour per consignment

Direct Delivery (urgent release) Consignments

The timeframe for clearance of urgent release consignments by freight is as follows:

- Clearance of perishable shipment within 2 hours after taxi of aircraft.

- Clearance of transshipment cargoes within 30mins.

- Clearance of expedite shipments (Diplomatic/Embassy) within 30mins.

Courier

The timeframe for clearance of courier is as follows:

- Risk assessment of courier – Screening of manifest within 1 hour.

- Documentation clearance within 1 hour.

- Handling of courier packages – Clearance of non-dutiable packages within 90 minutes per consignment.

- Issuance of pending slip – Retention of taxable shipment. i.e. commercial goods and personal goods exceeding customs value of SCR3000 within 15 minutes per pending slip.

- Computation of taxes – Preparing payment voucher within 15 minutes per shipment.

- Pending release – Clearance of retained goods with customs value more than SCR5000 within 15 minutes per shipment.

Export Process

- Processing of documents for shipping order within 48 hours.

- Booking of appointment for verification of container within 24 hours prior to verification.

- Endorsement of shipping order within 24 hours before cut-off time.

- Supervision of loading and unloading of containers within 4 hours.

Bond and Excise Application Approval Process

- Approval should not take more than 21 working days to process once the application and all supported document has been submitted to Customs.

Refund Application

- Refund application should not take more than 30 working days to process once the application and all supporting documents has been submitted to Customs

Extension for Temporary Admission Process

- Application for extension for temporary admission should not take more than 10 working days.

Calculation of Tax Liability on the Disposal of Concessionary Goods

- The application and issue the assessment note should not take more than 14 days to process.

Issuance of a Disposal Certificate for Bonded Goods

- The certificate of disposal should be issued within 10 working days after the disposal has been done.

Clearance of Courier

- Clearance of courier should not be more than 5 hours.

Binding Tariff Ruling

- Within 10 working days

Publication of Binding Tariff Ruling

- Should be done within 15 working days after it has been issued (it is publication of the classification advise on the website)./li>

The service delivery standards is managed by the taxpayers education and service delivery unit. Should you want to share your feedback about our service, please email advisory.center@src.gov.sc . We are ready to assist further to improve your experience when dealing with us

Access to information

Access to Information ACT, 2018 “An act to foster good governance through enhancing transparency, accountability, integrity in public service & administration, participation of persons in public affairs, including exposing corruption, to recognize the right of access to information envisaged in Article 28 of the Constitution and for matters connected therewith and incidental thereto.”Information Officer – In accordance with Section 7(1) of the Access to Information Act, 2018, all public bodies are required to designate an Information Officer (IO) responsible for processing public requests for information. The Information Officer for the Seychelles Revenue Commission (SRC) is:

Post Title: Director, Corporate Planning and Research Unit / Information Officer

Email: jeniffer.jasmin@src.gov.sc

Contact: 4294936 / 2718517

Request for Information Form – Please click here to access the Request for Information Form should you wish to request any information under the Access to Information Act.